Topics: Negligence, Products Liability, Andy Allen v. RJR, Engle Progeny, Tobacco Litigation, Mass Torts, CVN Florida, News

Tobacco Manufacturers Hit With $4M Verdict in Engle Progeny Lung Cancer Suit

Posted by Arlin Crisco on Nov 22, 2014 7:53:00 AM

Topics: Negligence, Engle Progeny, Tobacco Litigation, CVN Florida, News, Perrotto v. RJ Reynolds

Topics: Negligence, Engle Progeny, Tobacco Litigation, CVN Florida, News, Perrotto v. RJ Reynolds, Schleider v. R.J. Reynolds

$21M Award to Smoker's Widow in Suit Against R.J. Reynolds

Posted by Arlin Crisco on Nov 19, 2014 7:00:00 AM

Topics: Negligence, Engle Progeny, Tobacco Litigation, Mass Torts, News, Schleider v. R.J. Reynolds

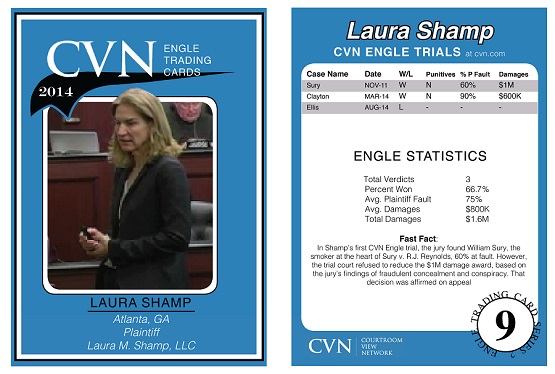

Each Tuesday we issue a new trading card featuring an attorney, trial, or firm from Florida’s Engle progeny tobacco cases. Our exclusive cards provide a light-hearted way to track important statistics throughout this landmark tobacco litigation.

Topics: Engle Litigation Trading Cards, Engle Progeny, Tobacco Litigation, CVN Florida