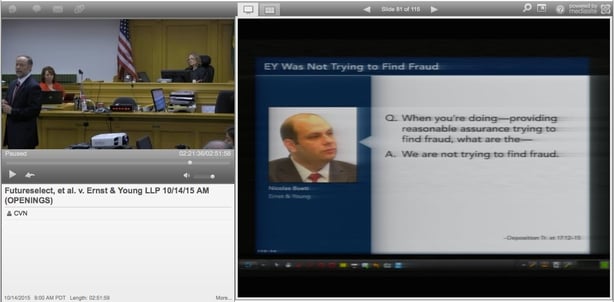

Plaintiffs' attorney Steven Thomas shows jurors deposition testimony from an Ernst & Young partner while arguing that the accounting firm is responsible for his clients losing millions in funds advised by Bernie Madoff. Click here to see video from the trial.

Seattle — An investment firm that saw $112 million vanish in Bernie Madoff’s historic Ponzi scheme took Ernst & Young to trial on Tuesday in Washington state court, claiming that the accounting giant is responsible for the loss due to supposedly certifying billions in assets that didn’t exist.

An attorney for FutureSelect Portfolio Management Inc. told jurors during his opening statement that Ernst & Young failed to adequately audit a Madoff feeder fund the firm invested in, Tremont Group Holdings, and instead took Madoff’s word about the existence of securities that had been completely fabricated.

“The evidence will show that Ernst & Young signed its name to $4.2 billion of fake assets,” said Steven Thomas of Thomas Alexander Forrester LLP, according to a Courtroom View Network webcast of the trial.

The case is being closely watched, as trials in investor suits against accounting firms seeking to recoup losses over negligent auditing are extremely rare. It is also one of the few civil cases to go before a jury out of the plethora of litigation spawned by the $17 billion meltdown of Madoff’s scheme in 2008.

Had Ernst & Young refused to sign off on Tremont's investments, Thomas said FutureSelect would have seen it as a “huge red flag." Instead the Big Four accounting firm gave their seal of approval to fraudulent documents, like a financial statement claiming the existence of $853 million in fictional Treasury bills, Thomas argued.

“Auditors matter as the gatekeepers, and it’s this reliance by investors like FutureSelect that imposes the public interest responsibility,” Thomas said. “What Ernst & Young says matters.”

Ernst & Young denies the allegations, claiming that it adhered to standard accounting practices, and that Madoff’s fraudulent activities went undetected for three decades by both federal and state regulators, law enforcement authorities and numerous independent audit firms.

“No audit of a Madoff-advised fund could have detected this Ponzi scheme,” Ernst & Young spokeswoman Amy Call Well said in a statement. “EY was not the auditor of any Madoff entity, we were among the many auditors of funds that chose to use Madoff as their investment adviser.”

During his opening statement on behalf of the accounting firm, James Bennett of Morrison & Foerster LLP told jurors that Ernst & Young sympathizes with the investors who lost money due to Madoff’s fraud, but that FutureSelect bore responsibility for putting money into funds with returns the investment firm should have known “were too good to be true.”

“Ernst & Young did its job, full stop,” Bennett said.

Tremont, the second-largest feeder fund in Madoff’s scheme after Fairfield Greenwich Group, struck a $1 billion deal in 2013 with investors to settle litigation over Madoff-related losses. Redmond-based FutureSelect opted out and sued Ernst & Young in 2010 under the Washington State Securities Act, which offers more stringent investor protections than many other state or federal statutes.

A trial court judge threw the case out, but it was later revived by an appeals court in 2013. In 2014 the state’s supreme court affirmed that decision, finding that the Act gives special emphasis to protecting investors from fraudulent schemes, and that FutureSelect had adequately plead that its investments were influenced by Ernst & Young’s audits.

In addition to the nearly $200 million in damages Ernst & Young could face, the outcome of the trial will also be key in determining whether or not a secondary actor like an auditor can be found directly liable under the Act for investment losses.

Tremont, its parent Oppenheimer Acquisition Corp. and Oppenheimer parent Massachusetts Mutual Life Insurance Co. were originally listed as defendants, but they were all eventually dismissed after reaching confidential settlements with FutureSelect, according to court records.

The trial before Judge Beth Andrus is expected to take approximately one month to complete, and is being webcast and recorded gavel-to-gavel by Courtroom View Network.

FutureSelect is represented by Thomas Alexander Forrester LLP and by local counsel Gordon Tilden Thomas & Cordell LLP.

Ernst & Young is represented by Morrison & Foerster LLP and by local counsel Davis Wright Tremaine LLP.

The case is FutureSelect Portfolio Management Inc. v. Ernst & Young, case number 10-2-30732-0, Superior Court of the State of Washington for King County.

E-mail David Siegel at dsiegel@cvn.com.