$48.8M Awarded To Comatose Man Struck By City Garbage Truck In Zero-Offer Case: Watch Full Trial via CVN

Posted by David Siegel on Jul 18, 2025 12:24:14 PM

Topics: California, Hakimi v. City of Los Angeles

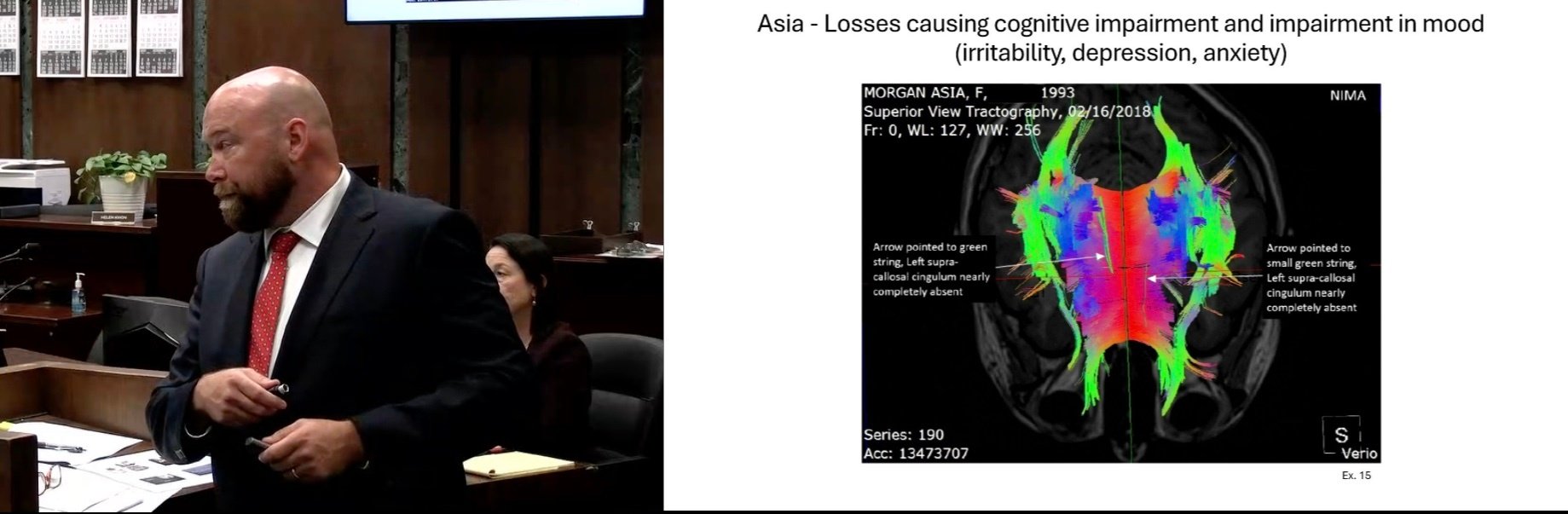

Trucking Co. Hit With $21.3M Verdict Over Rear-End Crash, Beating $50K Pre-trial Settlement Offer

Posted by David Siegel on Jul 16, 2025 3:43:01 PM

Topics: California, Angela Pope-Morgan, et al. v. Leilei Chen, et al.

Comatose Man Seeks $85M After Being Struck By City Garbage Truck: Watch Full Trial via CVN

Posted by David Siegel on Jul 11, 2025 10:40:47 AM

Topics: California, Hakimi v. City of Los Angeles

Logging Company Defeats $73M Wrongful Death Lawsuit: Watch Full Trial via CVN

Posted by David Siegel on Jul 7, 2025 3:23:16 PM

Florida Jury Rejects $17.8M Vacation Resort Premises Liability Trial: Watch Gavel-to-Gavel via CVN

Posted by David Siegel on Jul 2, 2025 1:57:58 PM