UPDATE 2/27/18: Jurors Tuesday cleared MassMutual of financial responsibility in a claim brought by 300 insurance policyholders who argue the company failed to pay dividends they were owed.

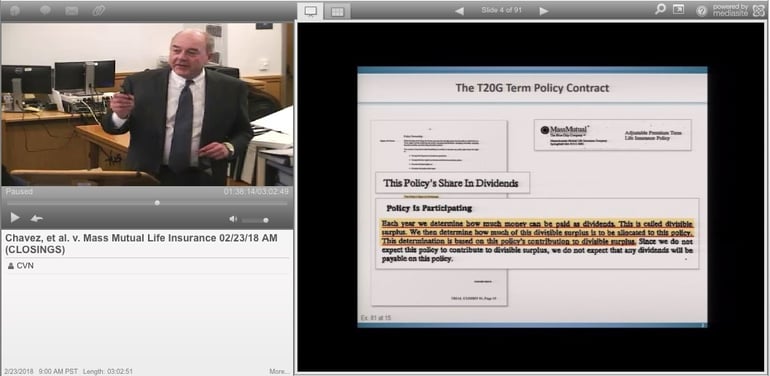

After two days of deliberations, jurors found MassMutual breached its duty to make a fair, good-faith annual determination of whether the T20G life insurance policies it issued to class members contributed to company earnings that were subject to dividend payouts. However, the jury concluded plaintiffs didn't prove the policies actually contributed to those earnings, known as the divisible surplus, thus denying the class' damage claim.

Los Angeles - A California state court jury heard closing arguments on Friday in a class action lawsuit brought on behalf of 300 MassMutual term life insurance policyholders who accuse the company of failing to pay contractually owed dividends as its profits soared.

Attorneys for plaintiff Christina Chavez, who serves as the class representative, argued that MassMutual breached its contract with policyholders in the Los Angeles area who purchased 20-year term life insurance policies, known as T20G policies, from 2000 to 2004.

Timothy Morris of Gianelli & Morris told jurors during his closing argument that because MassMutual is owned by its policyholders it had an obligation to pay out excess profits each year, but failed to do so from 2000 to 2010. He said MassMutual improperly withheld $717,000 in dividends owed to the class members.

MassMutual maintained that the T20G policies were “bare bones” plans, and that the company was only required to pay out dividends on more expensive whole life policies that generate a profit.

The full trial was webcast and recorded gavel-to-gavel by Courtroom View Network.

Morris told jurors that MassMutual’s total surplus profits doubled from $5 billion to $10 billion from 2000-2010, but that the the company never performed the accounting analysis necessary to determine whether T20G policyholders should receive dividends.

“They never made that annual determination. They didn’t,” Morris said. “They admitted it dozens and dozens of times. They promised in the contract they would make an annual determination, and they never once did.”

Morris suggested MassMutual’s compensation structure for top actuaries created a conflict of interest, since dividend payments reduced the amount of profit-linked bonuses the actuaries received.

MassMutual’s attorney Jennifer Keller of Keller/Anderle LLP told the jury during her closing argument that Chavez’s policy did not contribute to any divisible surplus and did not earn any dividends, making Chavez ineligible for any payout.

“That’s the case right there,” Keller said. “That’s it.”

Keller argued that MassMutual met its only obligation to Chavez when it paid her a $1 million death benefit after her husband passed away. However Keller stressed that the T20G policies failed to meet even their conservative five percent profit margin, and that MassMutual is only obligated to pay dividends on more expensive and profitable policies.

MassMutual agreed to a $37.5 million settlement in 2017 in Massachusetts federal court in a similar, though much larger class action lawsuit over allegedly unpaid dividends. That case involved 2.9 million policyholders from throughout the United States.

In addition to Timothy Morris, the Chavez class is also represented by Mary T. Rahmes.

MassMutual is also represented by Jesse Gessin of Keller Anderle, and by Joel Feldman, Christopher Assise, Sean Commons and Melissa Evidente of Sidley Austin LLP.

The trial took place before Judge Maren Nelson, and gavel-to-gavel video of the full trial is available to CVN subscribers.

E-mail David Siegel at dsiegel@cvn.com